See how Large Speculators are Positioned in the FX Market

Get the New CFTC Report

- Spot ‘pain’ points for stretched long or short positions

- Confirm momentum

- See large speculators add to longs or shorts

Get your FREE weekly copy of our new CFTC Report

Want to try the hard way?

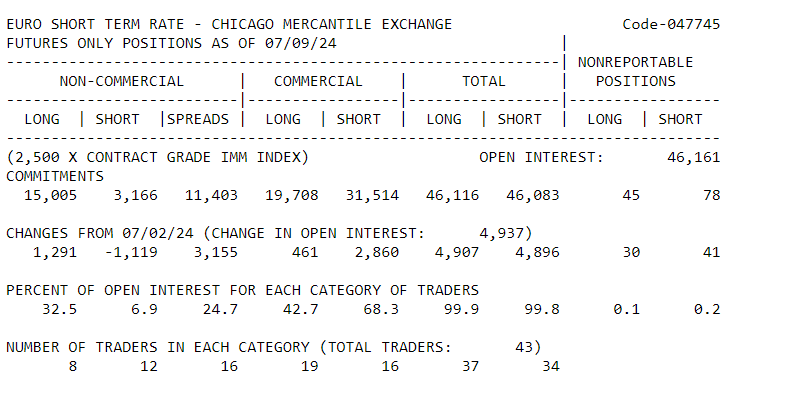

For years the CFTC report was hiding in plain sight – easy to access but virtually impossible to figure out.

Dedicated traders and researchers KNOW that the CFTC report gives them key information on what the position size of hedge funds and large speculators are that move the market.

But the CME only releases the RAW information. It looks like this…

Here at Financial Source we know this information is valuable:

It’s how we find some of our best trades!

We use it in 3 key ways.

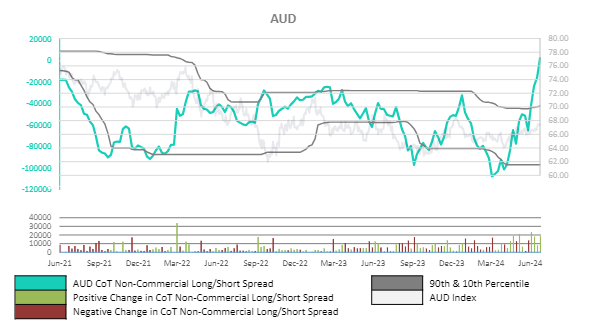

We like to find currency pairs that have long or short interest over the 90th percentile. This means if large speculators are putting positions long the EUR/USD and they are doing so above the 90th percentile recorded…those buy positions are highly vulnerable to news that would cause the EUR/USD to sell off.

We also use the CFTC report to confirm momentum. If we start to see positions tick up week over week in line with our fundamental bias and price continues in our direction – we might decide to go with the break and hold the trade longer.

Then we also monitor the aggression of large speculators adding to their positions week over week. This gives us an excellent indication of where a trade could be going.

In fact, the CFTC is so valuable we decided to take the RAW data and put it into a weekly report.

The green lines are the large speculators and the grey horizontal lines are the 90th and 10th percentiles.

You can see in an instant as of this writing that large traders and hedge funds are aggressively buying the Aussie far above the 90th percentile as calculated over the past few months.

We’ve prepared this for every major currency.

Get your weekly copy by signing up below!