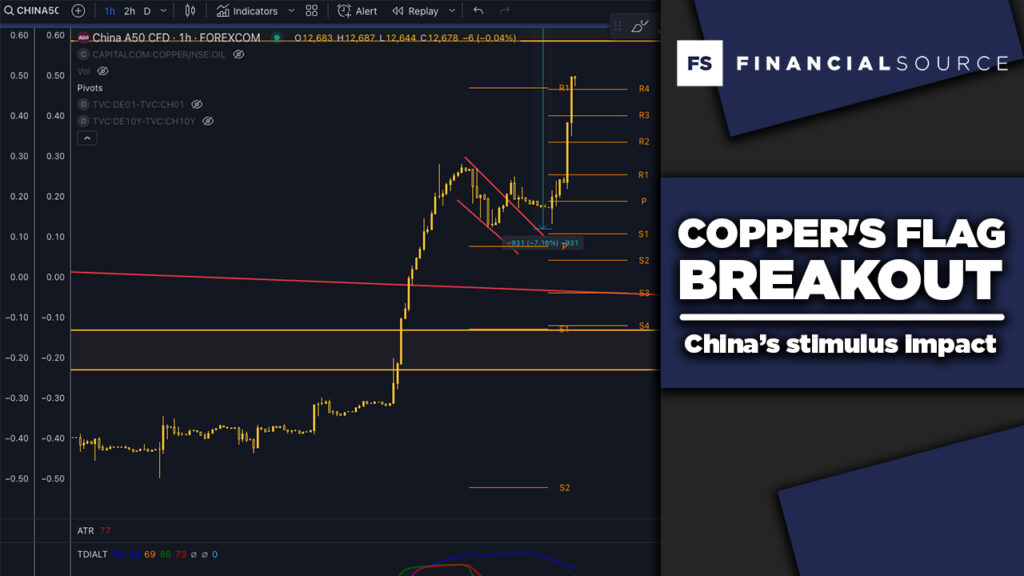

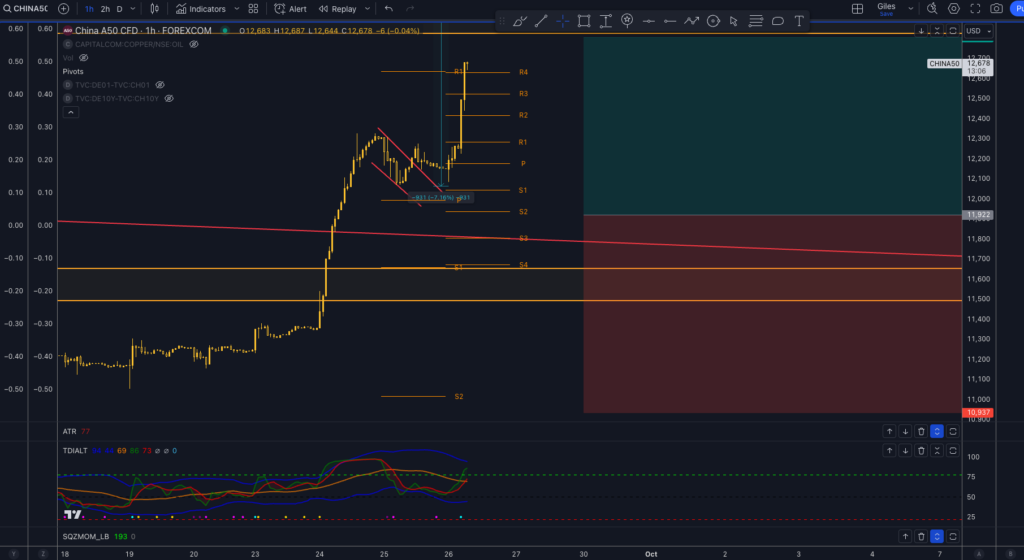

Copper's Flag Breakout: China Stimulus Impact

Copper prices are on a strong upward trajectory, breaking out after China’s recent stimulus measures were unveiled at the Politburo meeting on September 26. The Politburo’s detailed plan aims to inject much-needed liquidity and fiscal support into the Chinese economy, which has directly influenced the bullish sentiment in the copper market.

China’s initiatives include lowering the reserve requirement ratio, which releases more capital for banks to lend, and implementing forceful interest rate cuts. These moves are part of a broader effort to strengthen China’s economic fundamentals, which the Politburo describes as “favorable” and “resilient.” Importantly, they have committed to ensuring necessary fiscal spending, increasing the income of low- and middle-income groups, and improving the consumption structure—steps that could lead to a rise in demand for copper, especially in infrastructure, construction, and manufacturing sectors.

Additionally, the Politburo is addressing the recent downturn in the property market, which has historically been a significant driver of copper consumption. Their plan includes stabilizing the property market by strictly controlling the number of new commercial home constructions and attracting investment to stabilize the sector. As the construction and housing industries rely heavily on copper, these measures are likely to boost demand. Moreover, the Politburo has stated its intention to support small and medium-sized investors and to implement reforms in the manufacturing sector, which is crucial as China consumes more than half of the world’s copper supply.

From a technical standpoint, the recent flag breakout in copper points towards an upward target near the 8,640 region. This pattern suggests strong momentum, and the policy-driven backdrop from China adds further support to this bullish bias. The ongoing policy focus on improving key sectors such as construction, transportation, and electronics also reinforces the view of a potential sustained increase in copper demand.

However, traders should be mindful of the potential risks to this outlook. While the Chinese government is signaling a forceful response to economic challenges, the effectiveness of these measures remains uncertain. If the stimulus fails to have a lasting impact on China’s economic growth or if other global market risks, such as weakening global demand or geopolitical tensions, start to dominate market sentiment, copper prices could face a swift reversal. As such, it’s crucial to set tight stops just below the flag’s low to protect against any unexpected downturns.

In summary, China’s comprehensive policy measures have created a supportive environment for copper. Still, the long-term effects of these interventions and the global market context should be closely monitored as they will ultimately shape the trajectory of copper prices in the coming months.