The Ascending Channel: Your Guide to Mastering This Chart Pattern

What’s an Ascending Channel?

Picture this: you’re looking at a chart, and the price of an asset is moving upwards. But it’s not just any upward movement; it’s a neat, organized march between two parallel lines. That’s your ascending channel. These lines slope up and frame a series of higher highs and higher lows. In simple terms, it shows you that the asset is in an uptrend, with buyers consistently stepping in to push prices higher.

How Does an Ascending Channel Form?

To spot an ascending channel, follow these steps:

- Identify the Trend: Start by finding an uptrend. Look for a pattern of higher highs and higher lows on your chart.

- Draw the Trend Lines: Once you’ve got the trend, draw two parallel lines. The lower one (support line) connects the higher lows, and the upper one (resistance line) connects the higher highs. They should be roughly parallel.

- Confirm the Pattern: For it to be a bona fide ascending channel, the price should touch each trend line at least twice. This helps confirm the channel’s reliability.

Why is the Ascending Channel Important?

The ascending channel isn’t just pretty to look at; it’s packed with useful information:

- Confirms the Trend: This pattern confirms that you’re in a strong uptrend. Knowing this helps you align your trades with the market direction, boosting your chances of success.

- Defines Support and Resistance: The trend lines act as dynamic support and resistance levels. The lower line supports the price, where buyers come in, while the upper line resists the price, where sellers step in.

- Offers Trade Opportunities: The price bouncing between these lines gives you multiple chances to trade. Buy near the support line and sell near the resistance line to make the most of these predictable movements within the ascending channel.

How to Trade with the Ascending Channel

To effectively trade using an ascending channel, start with fundamental analysis. This is crucial because you need a solid reason beyond just the technical patterns to buy or sell. Look for fundamental drivers like economic indicators, interest rate decisions, or geopolitical events that can influence market movements.

Get a guide on how to combine fundamental and technical analysis here

Once you have a fundamental basis for your trade, incorporate the following strategies within the ascending channel:

- Buy Near Support: With a strong fundamental reason in place, consider buying when the price nears the lower trend line. This is where you expect the price to bounce back up within the ascending channel. Place a stop-loss just below the support line to protect yourself if things go south.

- Sell Near Resistance: If fundamentals suggest a potential sell-off or lack of strength, you can sell or take profits when the price approaches the upper trend line. Expect resistance here and a potential price drop. A stop-loss just above the resistance line can safeguard against unexpected breakouts within the ascending channel.

- Trade Breakouts: Sometimes, the price will break out of the ascending channel. If fundamental analysis supports a strong move, a breakout above the resistance line signals a bullish move, so you might want to buy. Conversely, a breakout below the support line could mean a trend reversal, making it a good time to sell or short. Look for increased volume to confirm the breakout from the ascending channel.

- Channel Trading: For those with more experience, channel trading involves buying near support and selling near resistance repeatedly within the ascending channel. It can be quite profitable in a trending market but be aware of the risks, especially with sudden breakouts. Always ensure your trades align with fundamental drivers within the context of the ascending channel.

A Practical Example

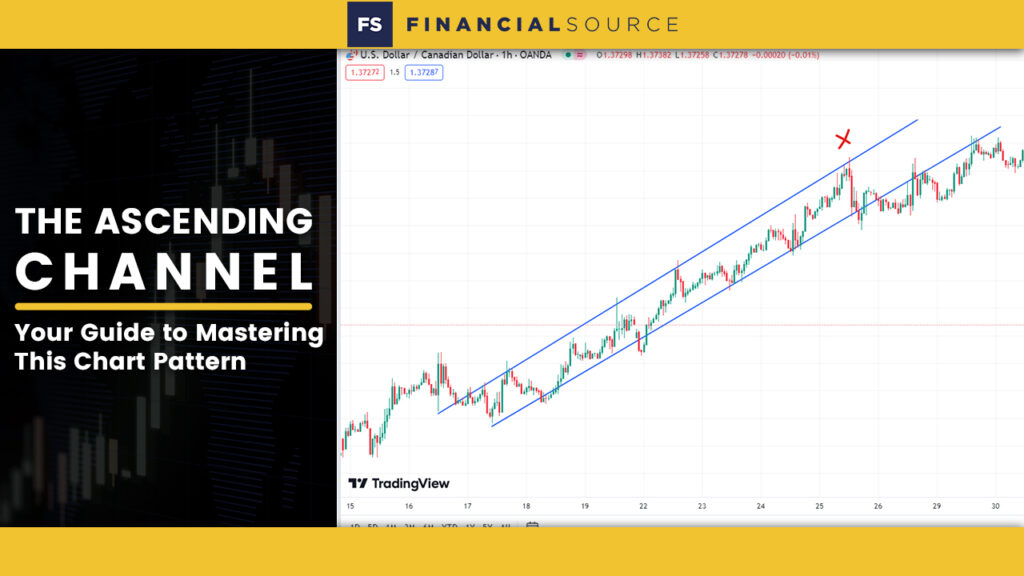

Let’s analyze the USD/CAD chart shown above. In this example, we see a well-formed ascending channel where the price oscillates between the support and resistance lines. However, at the point marked with an ‘X’, the pattern breaks down. This ‘X’ represents a Consumer Price Index (CPI) release.

The CPI release acted as a fundamental driver that significantly impacted the price movement. The CPI release acted as a catalyst that nullified the previously reliable ascending channel pattern. You might think that fundamentals are just about news releases, but at every point along the channel, there was a fundamental reason like market sentiment (a subset of fundamentals) to buy or sell that made it work.

This example underscores the importance of integrating fundamental analysis with technical patterns like the ascending channel. Without understanding the potential impact of fundamental events, you risk trading blindly and falling victim to sudden market shifts.

The Absolute Necessity of Combining Fundamental Analysis

Relying solely on technical analysis, like the ascending channel, severely limits your trading effectiveness. While these patterns provide valuable insights, they don’t capture the full market picture. Trading blind, without considering fundamental analysis, will likely lead to a losing win rate.

Why Fundamental Analysis is Essential

Fundamental analysis is crucial for making informed trading decisions. The market constantly seeks fundamental drivers to make significant moves, whether it’s selling at the top of the ascending channel, breaking out, or buying at the bottom. Ignoring these factors means missing out on critical information that can affect your trades.

For instance, economic indicators, interest rate decisions, and geopolitical events can dramatically influence market movements. When trading within an ascending channel, keeping an eye on these factors is essential. Strong economic data supporting a currency might drive the price to break above the channel’s resistance, while negative news can push the price below the support line.

Get our 26 free and concise news sources to keep up to date with fundamental analysis.

By blending technical analysis with fundamental analysis, you gain a more comprehensive understanding of market movements. This dual approach helps you make better-informed decisions, increasing your chances of success. It’s like having a complete toolkit rather than just a single wrench.

Wrapping It Up

The ascending channel is a versatile and powerful pattern in technical analysis. It helps you confirm trends, identify dynamic support and resistance levels, and find multiple trading opportunities. However, relying solely on the ascending channel without fundamental analysis is like navigating with one eye closed. To truly excel in trading forex or futures, you must integrate both technical and fundamental analysis. This combination, along with good risk management practices, will significantly enhance your trading strategy and success rate. With a bit of practice, you’ll find that the ascending channel, supported by solid fundamental analysis, can be a reliable guide in your trading journey.