Are you a Forex Trader Constantly ‘switching’ Technical Trading Systems?

Learn How to Trade Breaking News Events in 2025

Turn ‘dangerous’ News Trades into the Highest Conviction Opportunities

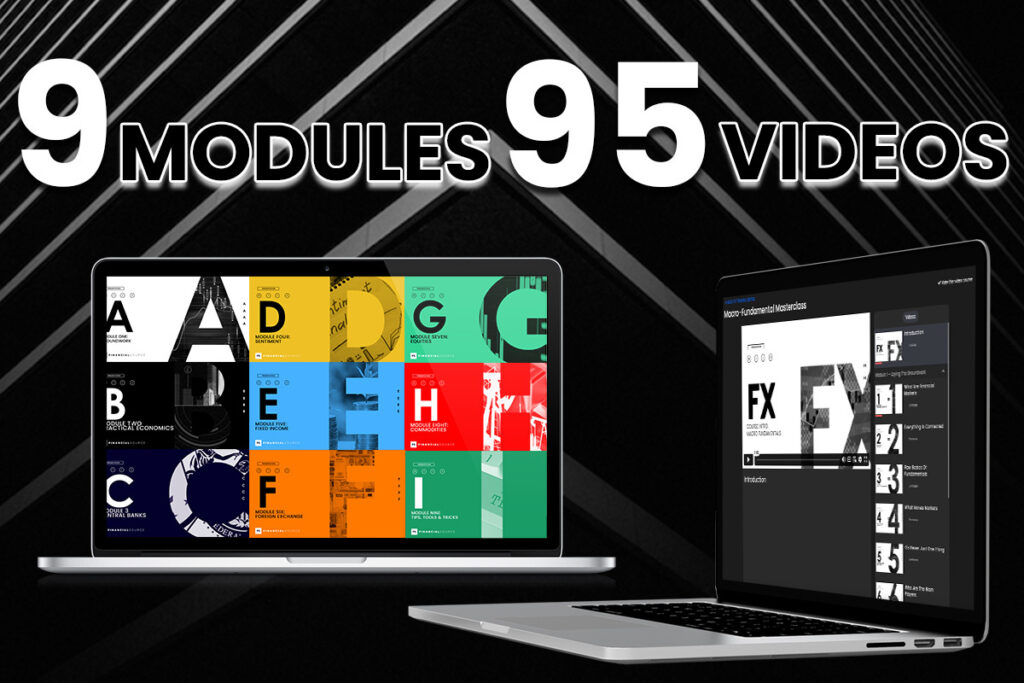

Get our macro fundamental masterclass

Get a Deep Understanding of the Main Players and How They Play the Game to Win

- Want to build a solid foundation at your own pace?

- Struggling to understand how to turn "fundamental analysis" into profitable trades?

- Go deep on Central Banks, Sentiment, Fixed Income, Forex, Equities, Commodities and how to put it all together!

- 9

MODULES

- 95

VIDEOS

FOR ALL TRADERS

MASTERCLASS COURSE OUTLINE

- 1. Laying The Groundwork

- What Are Financial Markets

- Everything Is Connected

- Raw Basics Of Fundamentals

- What Moves Markets

- It's Never Just One Thing

- Who Are The Main Players

- 3 Step Analysis Process (Intro)

- Some Basic Bias Terminology

- 2. Practical Economics

- Why We Care About Economics

- Economic Data & Economic News

- But Isn't Trading The News Dangerous?

- Economies Don't Move In Straight Lines

- Grid Economics

- Leading Lagging Coincident Indicators

- Economic Calendar Basics

- Some For Show & Some For Dough

- Leading Economic Indicators

- Coincident Economic Indicators

- Lagging Economic Indicators

- Important International Indicators

- Market-Based Leading Indicators

- How To Know When Incoming News Is Important

- 3 Step Analysis Process & Economic Indicators

- 3. Central Banks

- What Is A Central Bank

- What Is The Role & Goals Of Central Banks

- Most Important Central Bank Tools

- What's The Big Deal About Interest Rates

- Current, Neutral & Terminal Rates

- Quantitative Easing

- Quantitative Tightening

- Major Central Banks

- Quarterly Central Bank Projections

- Inflation Targeting

- When Inflation Gets Out Of Control

- Hawks & Doves

- Policy Normalization Versus Tightening

- 3 Step Analysis Process & Monetary Policy

- 4. Sentiment

- What Is Sentiment

- Why We Care About Sentiment

- What Drives Sentiment

- The Basics Of Risk Sentiment

- Underlying Versus Short-Term Risk Sentiment

- 3 Step Analysis Process & Sentiment

- 5. Fixed Income

- What Are Bonds

- Some Bond Basics

- Bond Prices & Bond Yields

- Understanding The Yield Curve

- The Yield Curve Shape Matters

- Inflation Is A Bond's Worst Enemy

- Short Term Interest Rate Derivatives

- 6. Foreign Exchange

- The Big 3 FX Drivers

- Relatives More Important Than Absolutes

- Don't Underestimate Expectations In FX

- Impact Of Supply & Demand On FX

- FX & Monetary Policy Divergences

- FX & Global Macro Themes

- FX & Geopolitics

- Currency Profile - United States Dollar

- Currency Profile - Euro

- Currency Profile - Great British Pound

- Currency Profile - Australian Dollar

- Currency Profile - Swiss Franc

- Currency Profile - Japanese Yen

- Currency Profile - Canadian Dollar

- Currency Profile - New Zealand Dollar

- 7. Equities

- What Are Equities & Equity Indexes

- Knowing Your Equity Index Country Specifics

- Knowing Your Equity Index Market Cap & Sector Weighting

- Major Equity Index Profiles

- Equities & The Economic Cycle

- Equities & Underlying Risk Sentiment

- Equities & Cyclicality

- 8. Commodities

- What Are Commodities

- Commodity Drivers Depends On Type

- Key Drivers For Oil Prices (Demand)

- Key Drivers For Oil Prices (Supply)

- Key Drivers For Oil Prices (Supply)

- Key Drivers For Oil Prices (Inflation & Risk)

- Oil Futures Contango & Backwardation

- Key Drivers For Gold

- 9. Tips, Tools & Tricks

- FX Risk Reversals

- Implied Volatility Ranges

- Implied Volatility Signals

- Trading Central Bank Decisions With Clear Shifts

- Trading Central Bank Decisions With Little Or No Shifts

- Important Basics About CFTC Positioning

- Using Momentum To Predict Volatility

- Rebalancing Flows

- OpEx & Quad Witching

- High Probability Day Trades

- High Probability Day Trades (Examples)

- High Probability Swing Trades

- High Probability Swing Trades (Examples)

Get our Risk Event STRATEGY Course

- 6

MODULES

- 6+

HOURS

- 27

VIDEOS

FOR ALL TRADERS

RISK EVENT COURSE OUTLINE

- Introduction

- Welcome

- 3-Step Analysis Process

- Process Before Profits

- The Basics Of 3-Step Analysis

- Trading Economic Data

- Not All Data Are Created Equal

- Criteria For Assessing Data Importance

- Step 1: The Baseline

- Step 2: The Surprise

- Step 3: The Bigger Picture

- Economic Data Trade Examples

- Introduction

- US NFP (1)

- Canada Jobs Report

- US CPI

- US ISM MFP PMI

- US ISM Services

- US NFP (2)

- Trading Central Bank Events

- Not All Central Bank Decisions Are Created Equal

- Step 1: The Baseline

- Step 2: The Surprise

- Step 3: The Bigger Picture

- Policy Decision Trade Examples

- Introduction

- BOC Policy Decision (1)

- ECB Policy Decision (1)

- BOE Policy Decision (1)

- SNB Policy Decision

- BOC Policy Decision (2)

- ECB Policy Decision (2)

- BOE Policy Decision (2)

Get the Professional Tools You Need included FREE

1. Interest Rate probability Tracker

Data pulled directly from the STIR markets, telling us the probability of a central bank hike. (Don’t worry, if you’re new - we’ll show you how to use it 🙂 For those of you that are more advanced - Only the Fed version exists in the market. We cover all the major central banks.

2. Our Real-Time Economic Calendar

There are many economic calendars. But ours shows you the appropriate highs and lows with a ‘thunderbolt’ feature. This thunderbolt instantly highlights a maximum surprise on data release leading to a tradeable opportunity.

Trade 8+ Major News Events Live With US Every Month

We’ll help you find those ‘no brainer’ high conviction trades as soon as the news breaks including entries, stops and targets

Some of the highest conviction opportunities come from…

Federal Open Market Committee Meeting (FOMC)

Non-Farm Employment Change

US CPI Release

GBP CPI Release

Bank of Canada Rate Statement

European Central Bank Monetary Policy Statement

Bank of England Official Bank Rate

Swiss Inflation

UK labour data

US non-farm payroll (NFP)

UK GDP

Canadian Labour data

European PMIs

US ISM data

European Inflation data

US GDP

CAD GDP

Get Everything in our Professional News Trading Package

- Macrofundamental Masterclass

- News Trading Strategy Course

- Complete Economic Calendar Package

- Live Trading News Events with Financial Source

Get all of the above for just $1497 for 3 months access

Two Live Accounts - Going for Maximum Allocation

“I started with Financial Source in 2018, it opened a whole new world to me.”

Financial Source is an Oracle of Trade Ideas

“Let me provide a simple example of how Financial Source has enhanced my trading objectivity both in swing trade ideas and intra-day trading.”

I’m trading a 400k live prop-account because of Financial Source

“In order to translate economics into trade ideas and manage those trades, you need day-to-day mentoring. The real turning point in my career was when I became a subscriber to Financial Source and I really mean it.”