Find Exact Entry and Exit Levels Derived from the Options Market

Get high-probability turning points with statistical backing from the options market.

Statistical boundaries. Real market data. Professional-grade precision.

Intermarket Analysis — Seeing the Bigger Picture

Most traders make the mistake of staring at a single chart and trying to make trading decisions in isolation. But the reality is that every market is connected to others in ways that directly influence price movement. This is where intermarket analysis comes in — a powerful approach that lets you see the full story behind the price action.

If you want to understand where the Australian dollar might be headed, don't just look at AUD/USD — watch what's happening with iron ore prices and China's economy. These are key drivers of Australia's exports and can often move the currency before the forex chart even shows it.

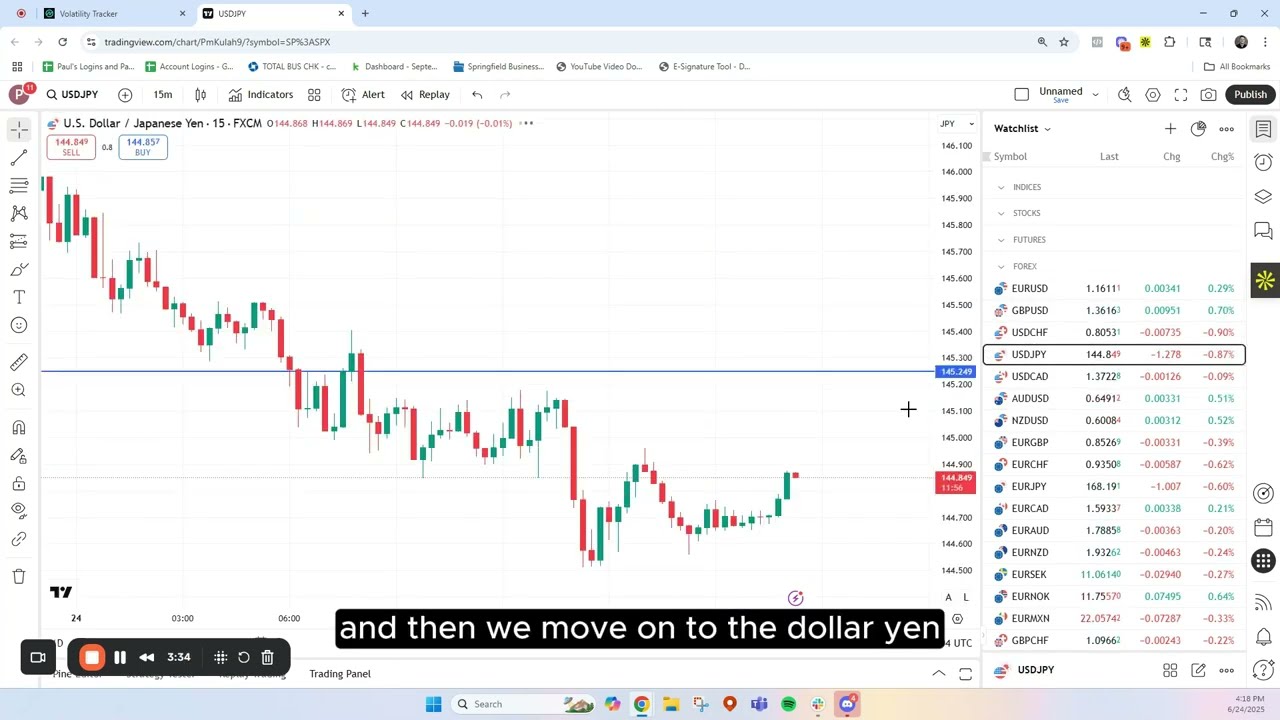

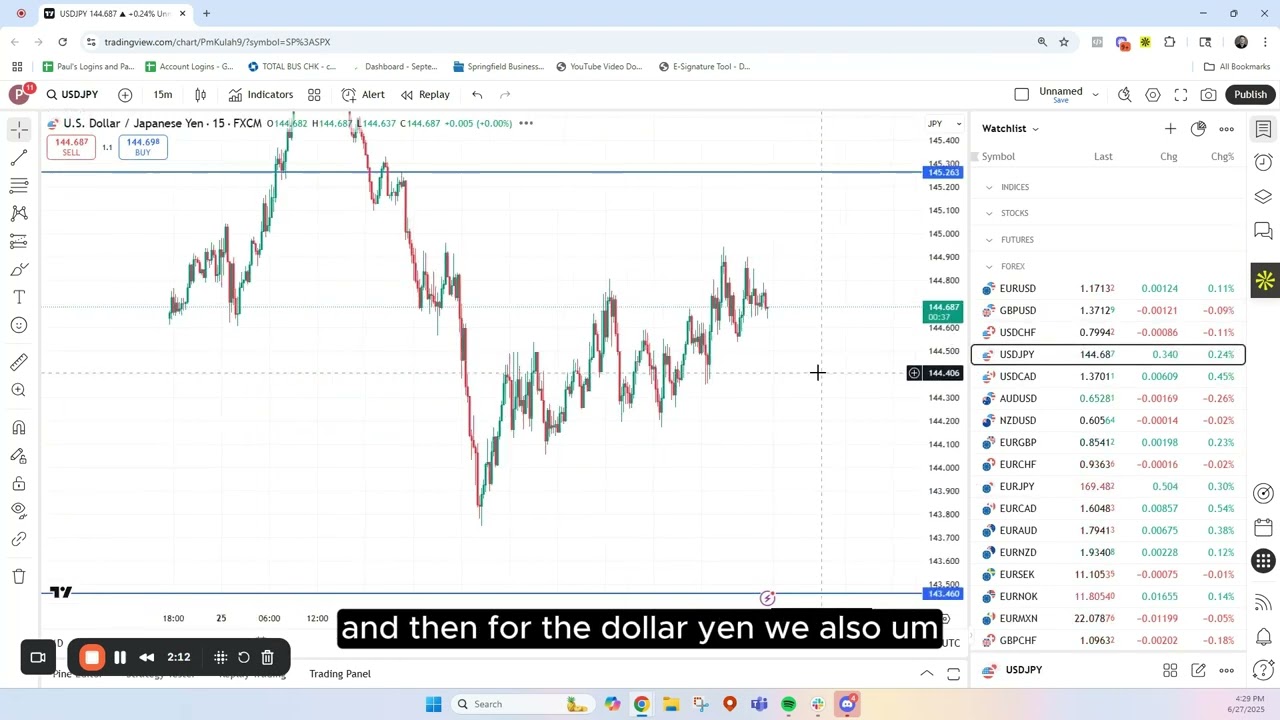

The same is true for USD/JPY. If you want to anticipate moves here, you need to be watching U.S. Treasury yields. When yields spike, the dollar often strengthens against the yen, and when they fall, the opposite can happen.

And if you want to find turning points in the Forex or Commodities Market you need to ask the Options Market.

What Is Implied Volatility and Why It Matters

Implied volatility is the market's forecast of how much price could move in the future, based entirely on real-time options pricing. Unlike guesswork or opinion, it reflects where the most sophisticated traders in the world believe volatility will be.

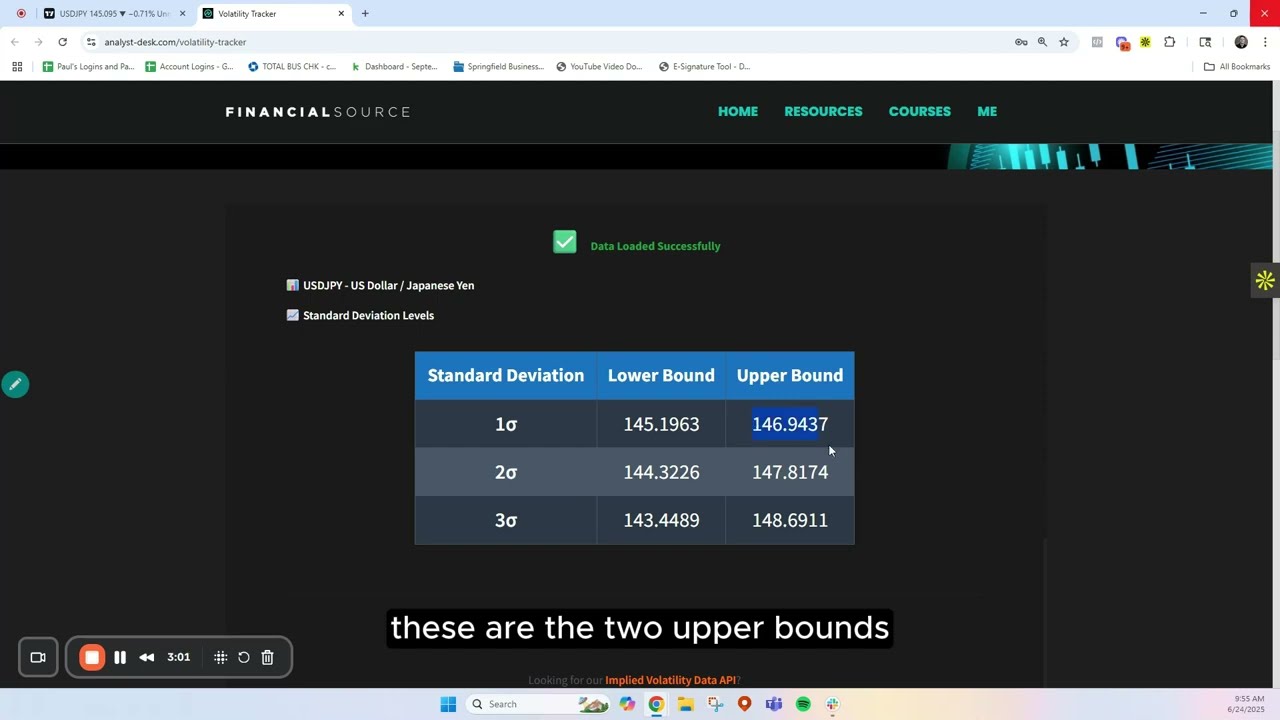

From this data, we calculate standard deviation bands — statistical boundaries that define where price is likely to stay. When price pushes into or beyond these bands, it often signals a high-probability turning point in the market.

These turning points can be incredibly powerful for traders in spot forex, commodities, and other markets. They can mark ideal entries when the market is stretched too far in one direction, and equally effective exits when a move has run its course.

How It Works

Our Implied Volatility Indicator pulls the latest options market data each day and translates it into clean, easy-to-read levels directly on your charts.

Common Strategies Using Implied Volatility Levels

High-probability approaches that align with how professionals use these statistical boundaries:

Straight Buying & Selling

Trade directly off the boundaries when there's no strong directional bias

Pullback Entries

Wait for a pullback against fundamentals to a key IV level before entering

Take Profit Levels

Use IV boundaries to lock in gains before the market reverses

Order Flow Scalping

Combine with live order flow in instruments like ES for short, high-probability moves

Upper Band: 151.20

Lower Band: 149.85

Statistical turning point reached

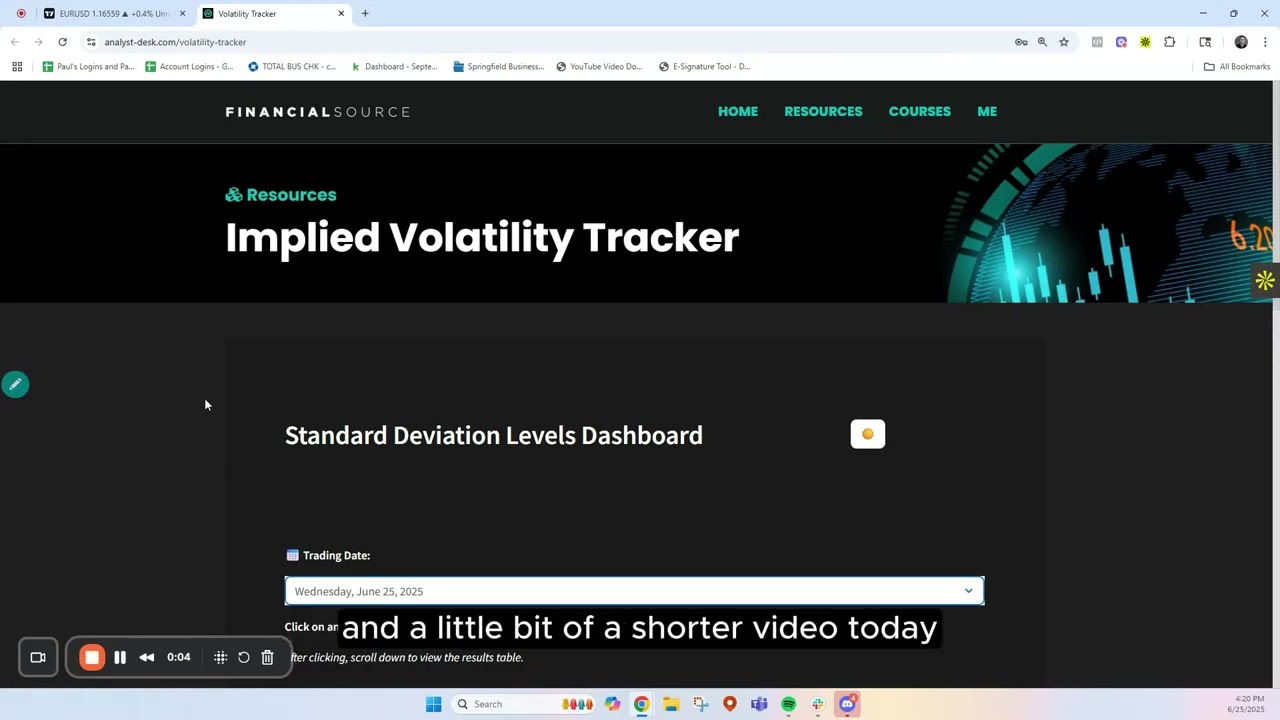

Your Daily Process in 60 Seconds

Open the date picker

Scroll back and view the previous 5 days of data if needed.

Select your instrument

Choose from forex pairs, commodities, or any instrument you're trading.

See IV turning points

Fresh data loaded daily by 11:30am London time—completely updated levels.

Plan your entries & exits

Use these high-probability zones to time your market positioning.

Simple, fast, and powered by the options market's own forecast.

Who This Is For

If you fit one of these profiles, this tool was built for you.

Forex traders

who want high-probability turning points with statistical backing.

Commodity traders

looking for entries and exits defined by real market expectations.

Intraday traders

who want fewer false signals and tighter risk control.

Scalpers

who thrive on precise, repeatable levels.

Why You've Never Seen This Before

Most retail traders are stuck with lagging indicators that simply react to what's already happened. Implied volatility levels are forward-looking, based on options market data — the same kind of information professional desks use every day.

Retail platforms rarely give you access to this kind of intelligence, and even when they do, it's buried in complex options analytics. We've streamlined the process so you can see exactly where the market is likely to turn, without sifting through endless data feeds.

Professional-Grade Data

Access the same options market intelligence that institutional traders rely on, delivered in a clean, easy-to-read format.

Forward-Looking

Unlike lagging indicators, our levels predict where the market is likely to turn based on real-time volatility expectations.

Simplified Access

Complex options analytics made simple — no need to dig through endless data feeds or learn complicated platforms.

What makes this approach different from traditional technical analysis?

Most technical analysis tools whether it's a trend line, a moving average, or even support and resistance levels are subjective. Two traders can draw the same chart differently and come to different conclusions.

Implied volatility levels are completely different. They're mathematically derived from options market data, meaning they're consistent, objective, and based on the market's own forecast of future movement. There's no guesswork, no re-drawing lines, and no interpretation bias just clear, statistically grounded levels you can trust.

Frequently Asked Questions

Live Examples

We chose a random week in June and recorded how each major currency pair reacted to our implied volatility levels in real time.