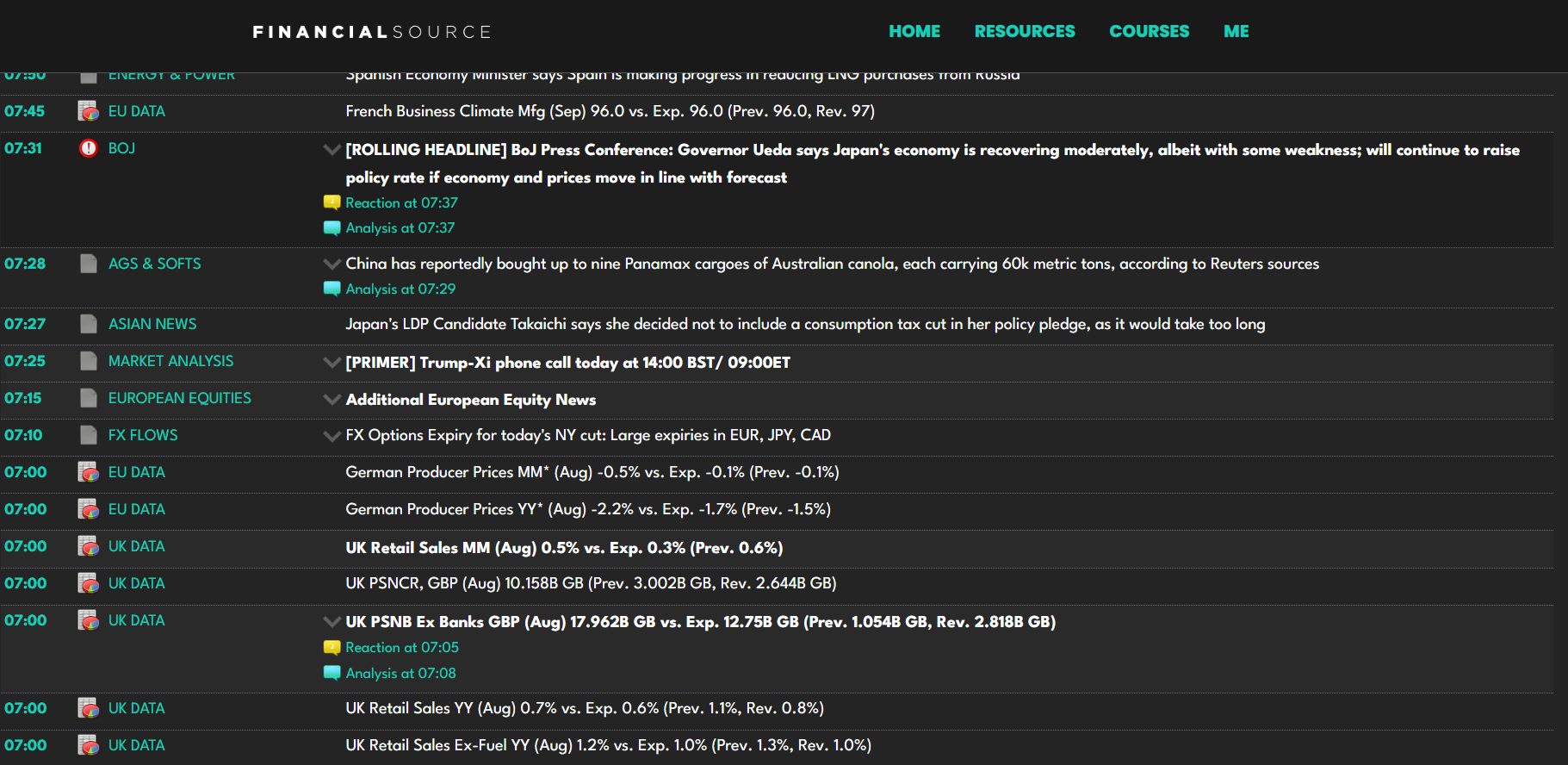

Live Audio Squawk Feed

Sub-second delivery - Market-moving events reach you faster than traditional media

Hands-free operation - Audio feed runs seamlessly while you execute trades

Expert curation - Professional analysts speak only when news impacts asset prices

Global market coverage - Continuous coverage across Asian, London, and New York sessions