To get more money out of your trades

Buy Strength, Sell Weakness & Find Extremes

Get the Macro Analysis Snapshot

• Instantly identify strongest and weakest assets

• Currency sentiment heatmap with positioning data

• Real-time extremes and turning point signals

Markets reward those who align with strength and punish those who fight it. In currencies, trends often run longer than expected—strong gets stronger, weak gets weaker—and the traders who can identify that early stand to capture the most.

The Macro Analysis Snapshot is built for exactly that purpose: giving you an instant, data-driven read on which markets have the wind at their back and which are fading fast. In just a few seconds, you'll know which index or currency pair will run the furthest—before the rest of the market catches up.

The Two-Pronged Problem

First, too many traders fight momentum by going against currencies that are already fundamentally strong or weak. They're swimming against the tide and wondering why their currency pair or instrument just won't move in their direction—only to look after the trade and find another pair that moved in the correct direction much further and much faster.

Second, traders don't know when an instrument is getting too stretched or too extreme. They get caught on the wrong side when fundamental data or expectations change, or when the market decides to take a breather—missing the warning signs that a reversal is coming.

The Two-Pronged Solution

Immediately pinpoint which assets are surging higher or breaking down hardest. This lets you put capital behind the cleanest momentum plays—so every trade carries maximum conviction and the potential for outsized returns.

By blending bank research, institutional positioning, and real-time sentiment signals, the indicator highlights when markets stretch too far. You'll see the moment consensus tilts too heavily in one direction—giving you the edge to fade the herd before the reversal hits.

What You Get

Three powerful tools that work together to give you complete market clarity in seconds.

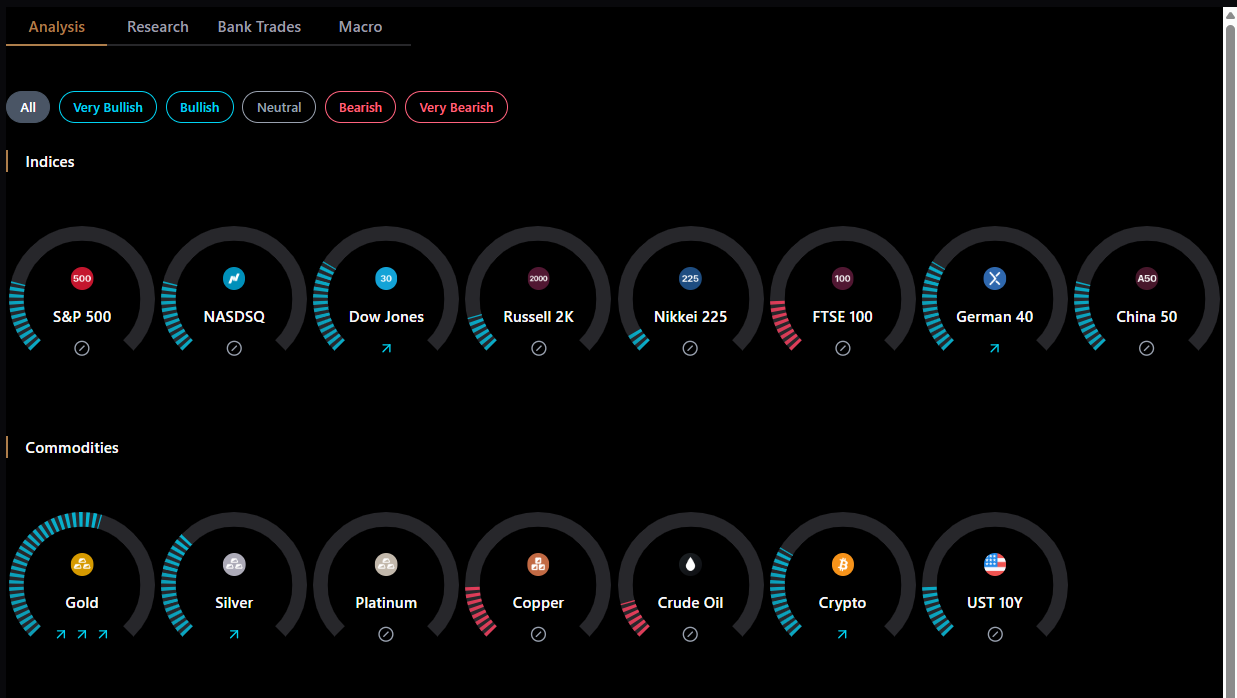

Dashboard Toggles

See the most bullish and bearish assets across indices, commodities, currency futures, and FX pairs in one clean view. Every score rolls up to a single dial so you can interpret the market at a glance.

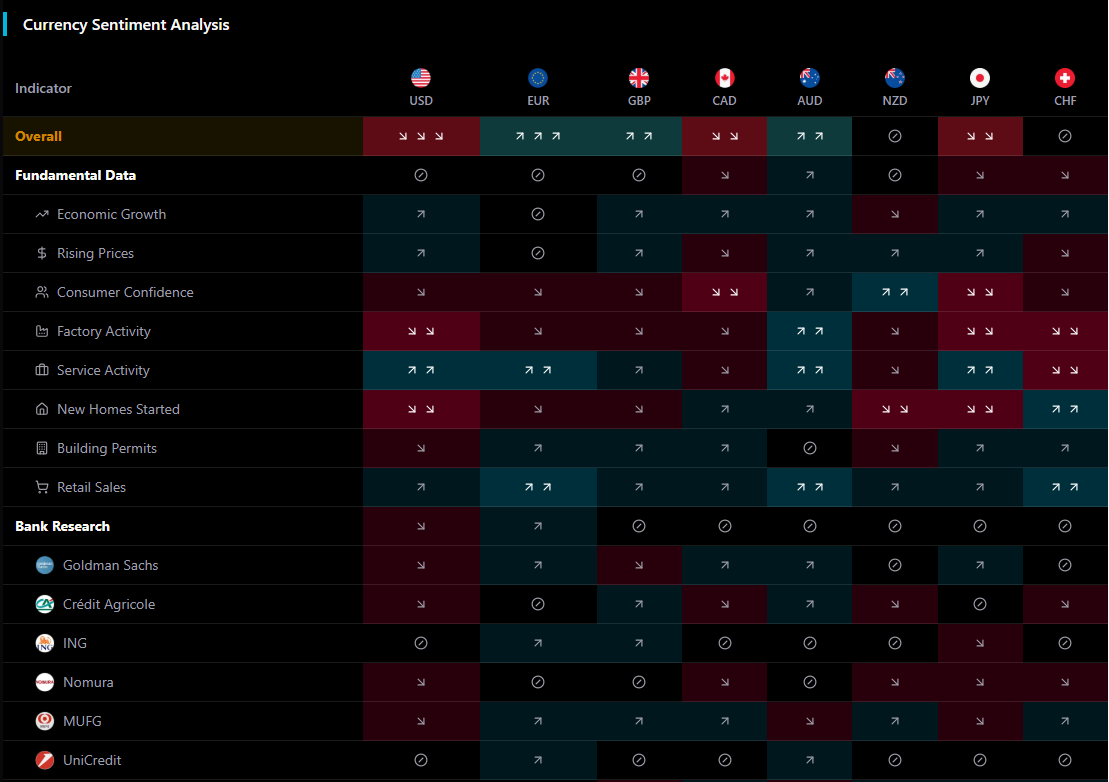

Currency Sentiment Heatmap

Get a unified read on each currency's backdrop—fundamentals like growth, prices, consumer confidence, and industry activity, plus positioning from hedge funds and retail traders, monetary policy stance, trend strength, and seasonality patterns.

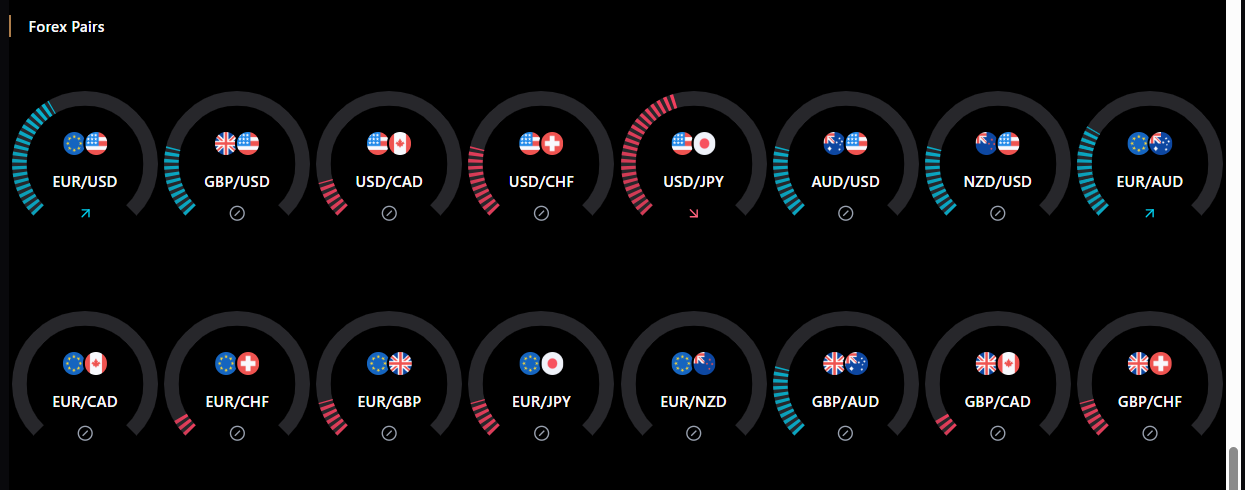

Forex Pair Strength

Instantly identify which currency pairs have the strongest momentum with clear visual indicators. Each pair shows strength/weakness with colored dials and directional arrows for immediate decision-making.

How It Works

Scan

Open the dashboard and note the top three strongest and weakest assets.

Select Expression

If you have a bias in a base currency, choose the cross with the highest supportive score.

Pressure-Test

Check the heatmap tailwinds and bank-consensus alignment to confirm your edge.

Execute

Enter your position with a clear stop-loss level. Look to move stops to break-even once the trend confirms.

Monitor Extremes

When sentiment clusters and banks crowd one side, prepare to fade the consensus as positioning unwinds.

Use-Case Examples

Swing GBP

"GBP bias long" → Macro Analysis Snapshot shows GBP/AUD and GBP/NZD most bullish. Choosing the stronger of the two can mean getting more money out of the trade.

CPI Print

USD trend already bearish; on a soft CPI surprise, short USD against the strongest counterpart in the Macro Analysis Snapshot rather than guessing.

Crowded JPY

Banks mostly bearish JPY; heatmap shows extremes; BoJ rhetoric shifts—fade the consensus with tight risk before the unwind begins.

_1755185061733.png)

Who This Is For

Swing Traders

Have a fundamental bias in GBP or JPY? Don't just pick a pair at random—target the strongest cross so your entry has built-in tailwind.

Risk-Event Traders

CPI, NFP, central-bank headlines—trade the pairs already trending in your direction so you can move stops to break-even quickly and ride the momentum.

Contrarians

Hunt extremes by watching sentiment stretch and consensus cluster in bank research—then fade when the cracks appear and positioning unwinds.

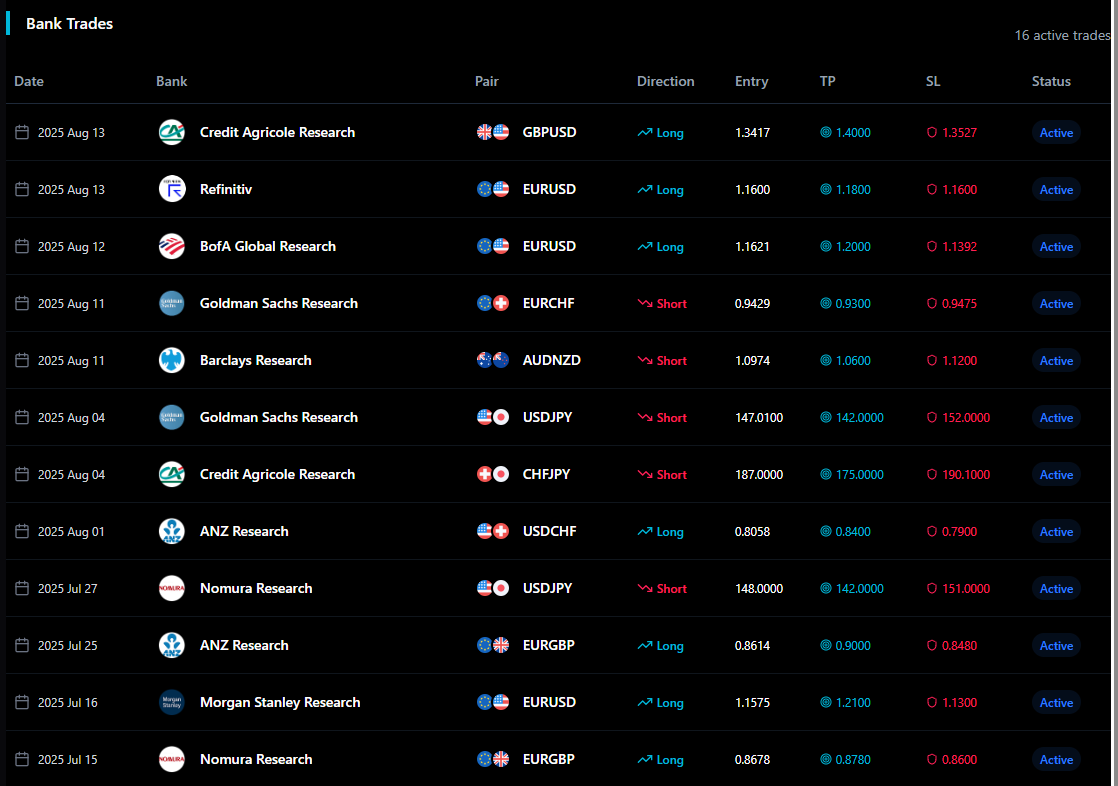

Major Bank Trades Included

Get exclusive access to all the major bank trades from Goldman Sachs, Credit Agricole, ING, Nomura, MUFG, and UniCredit. See exactly what the institutional players are doing—their directional calls, timing, and positioning—all consolidated in one place.

Real Bank Positions

Track the actual trades and directional calls from the world's largest trading desks

Institutional Edge

Follow the smart money and see when consensus is building or breaking down